Op-Ed

Op-Ed

Towards a society of multiple property owners?

These other publications may also be of interest to you:

Op-Ed

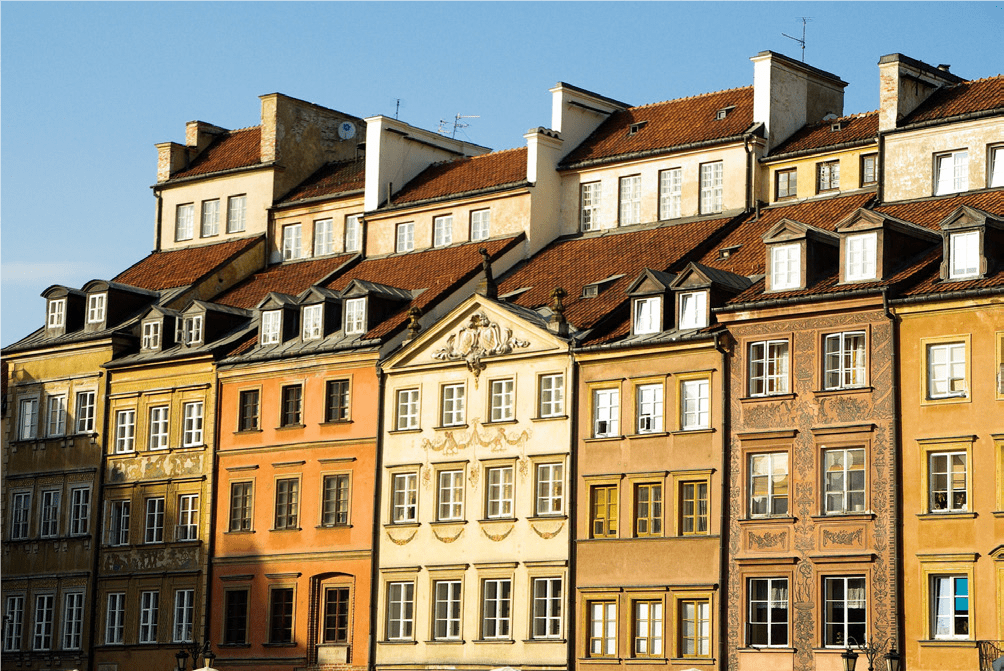

Long live urban density!

Op-Ed

The ideal culprit

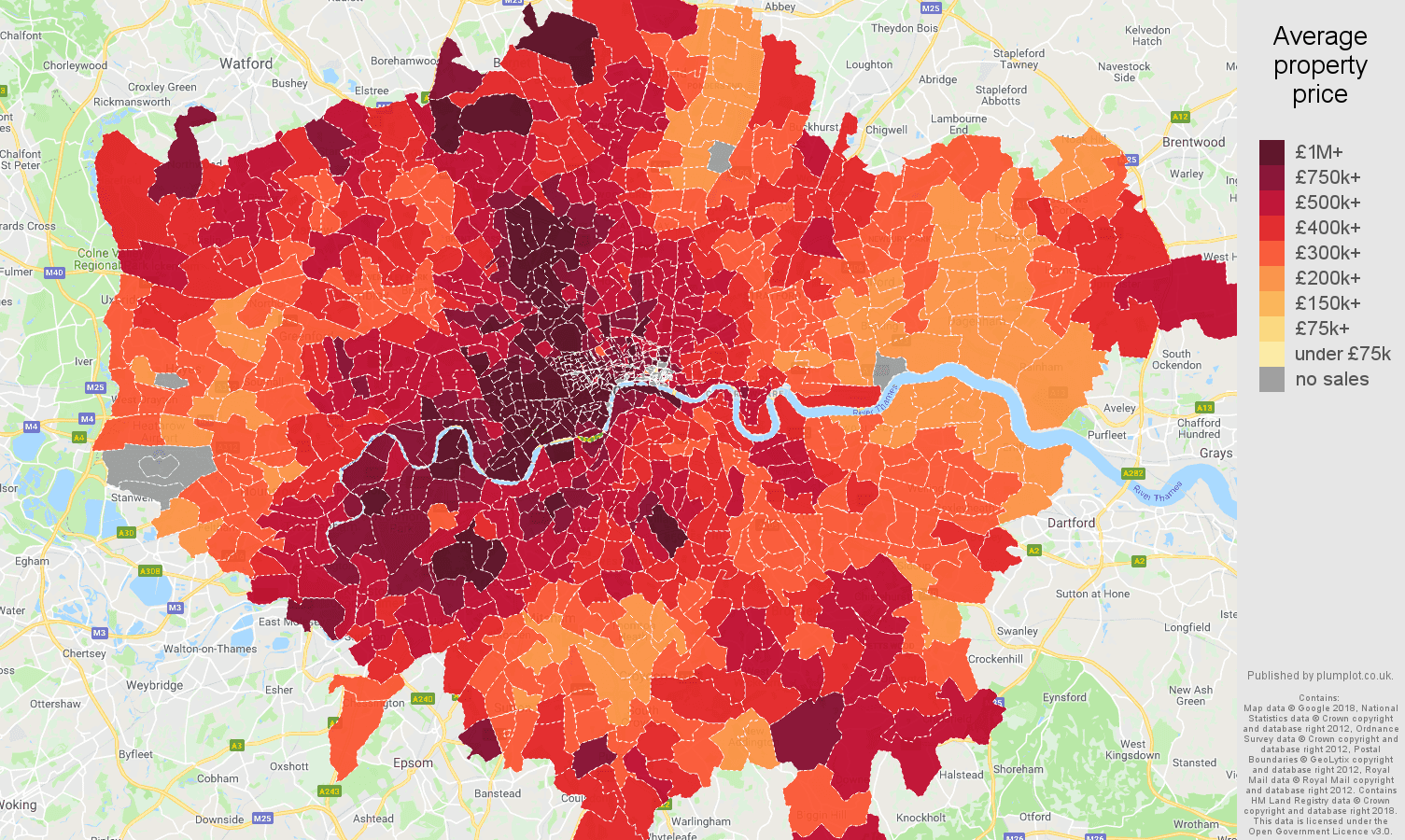

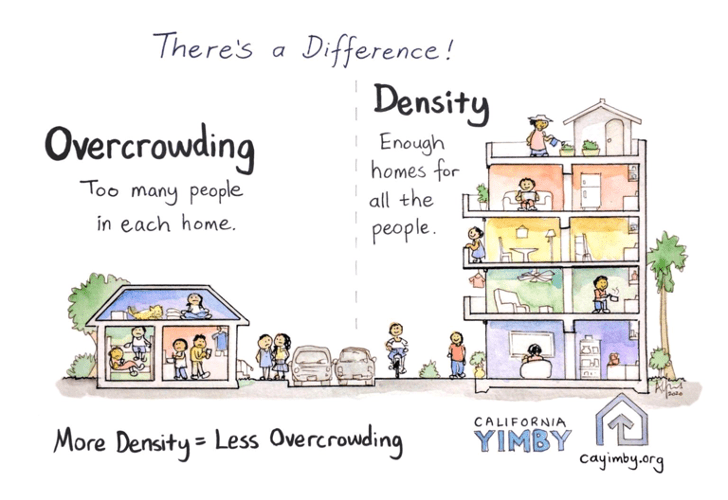

Issue brief

Behind the words: density

Issue brief

Behind the words: Affordable housing

Expert viewpoint

German metropolises and the affordable housing crisis

Inspiration notebook

Berlin Focus

La Fabrique de la Cité

La Fabrique de la Cité is a think tank dedicated to urban foresight, created by the VINCI group, its sponsor, in 2010. La Fabrique de la Cité acts as a forum where urban stakeholders, whether French or international, collaborate to bring forth new ways of building and rebuilding cities.